Egyedi kiegészítések

Kiegészítőinkkel maximálisan vállalkozásához igazíthatja az SAP Business One rendszerét

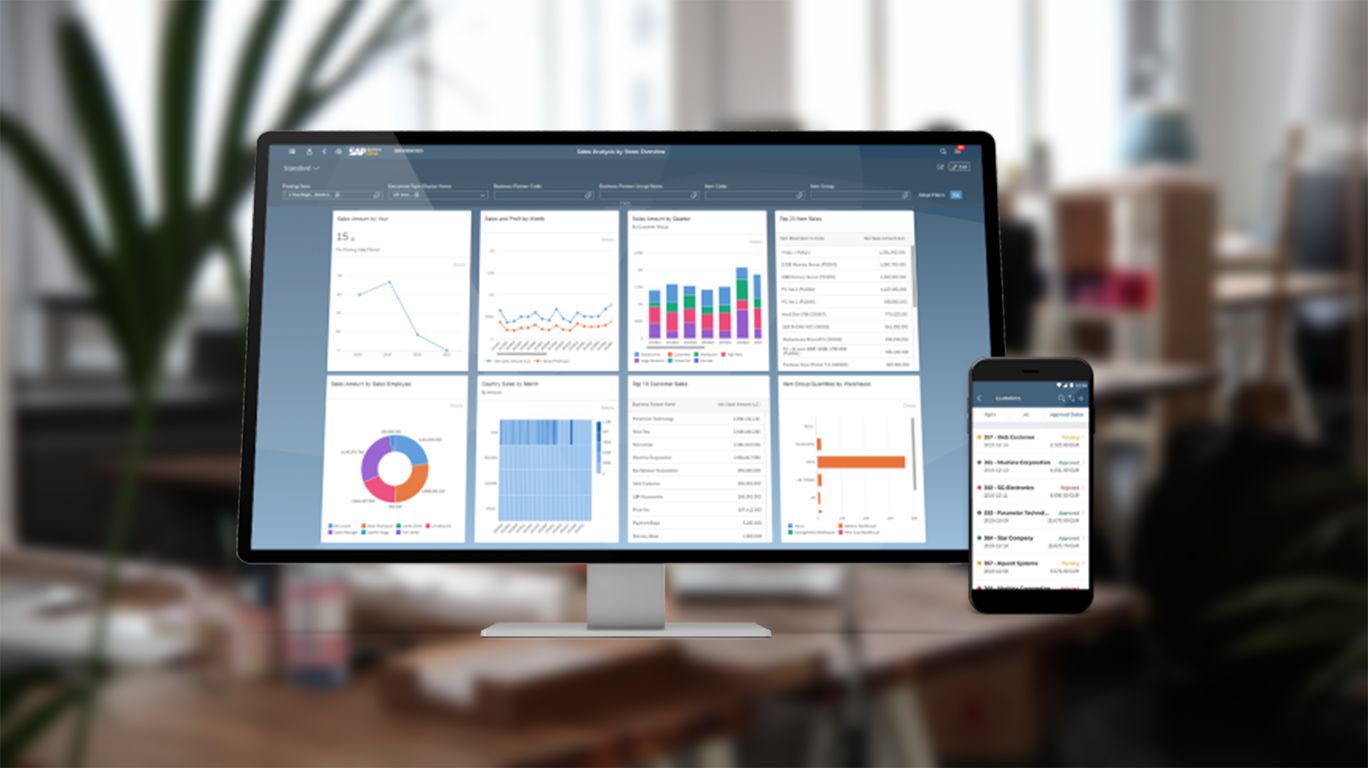

SAP Business One

Nagyvállalati szintű rendszer kis és középvállalkozások számára

Bemutatókérés

Tanácsadóink szívesen felkeresik Önt cége telephelyén, hogy bemutassák, termékeink miként javíthatják vállalkozása üzletvitelét